DOWNLOAD

DATE

Contact

Governments around the world are pouring money into the aviation industry as never before. Regardless of the forms these cash injections take (grants, loans, equity or tax deferrals), governments around the world are becoming de facto the next key stakeholders of aviation. They must thus finance a transformation that serves both citizens and the planet. In exchange for the financial support, governments should ask airlines to: (i) assure competitiveness through restructuring, and (ii) implement transition programs into a “green” aviation model. The future of aviation is being reinvented by all parties, including governments, which must also redefine their role in the industry, learning from past mistakes.

Aviation is a “backbone sector”, which justifies governmental bailout

Aviation connects people, businesses and cultures. It is also one of the few “catalyst” industries, which support and facilitate the growth of others, especially hospitality and tourism. For instance, the aviation industry more than doubled the number of international visitors around the globe, from 700m in 2000 to about 1.5bn in 2019 (source: WTO). Globally, the aviation industry accounts for US$2.7 trillion of GDP; it also directly and indirectly supports 65 million jobs in various industries, such as travel & tourism – which includes 2.7 million jobs with various airlines (source: IATA).

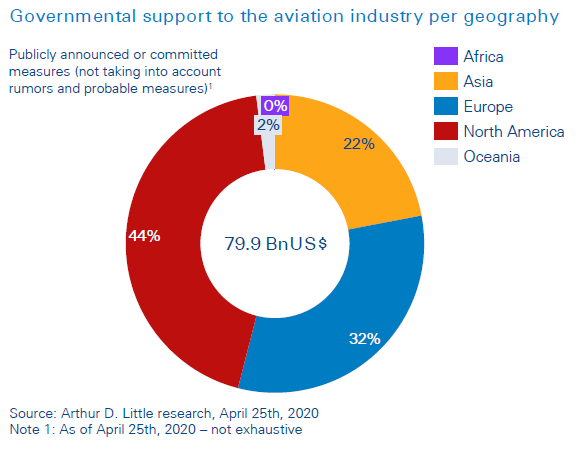

Public support packages for the aviation industry are therefore considered necessary to ensure the industry’s catalytic impact on socio-economic development can be sustained. So far, governments have committed close to $80 billion around the world, with possibly more to come in large countries such as the UK, Indonesia, Thailand, Japan and Brazil; this does not yet include China’s support to its state-owned aviation sector because this information has not been disclosed to date.

The aviation community (more than just airlines) needs government support like never before

All major crises for the aviation industry, as well as single airlines, have been marked by highly visible governmental intervention. But the COVID-19 crisis is unique because of its depth and width.

- Unprecedented depth: Prior to COVID-19, the biggest demand reduction in the aviation industry during any recent crisis was 2–5 percent annually, but with COVID-19, a 50 percent decline would be considered optimistic by many analysts. For comparison, the automotive industry experienced a 40 percent demand drop during the 2008 post-subprime crisis.

- Extraordinary width: Airlines have long been the “weakest link” in the ecosystem – but the COVID-19 crisis threatens all parties: airports and air navigation service providers (ANSPs), for instance, can no longer be seen as risk-free businesses. The COVID-19 crisis calls for global support for all parties of the aviation industry – not only airlines. To date, most governments have not considered this new paradigm. The US is an exception, with a $10Bn grant allocated to airports through the Aeronautical Information Publication (AIP) program.

Thus, the main question for both the aviation industry and governments is: how to make the best use of this investment in rescuing the industry?

Governments have four options for injecting money into aviation, but none are perfect

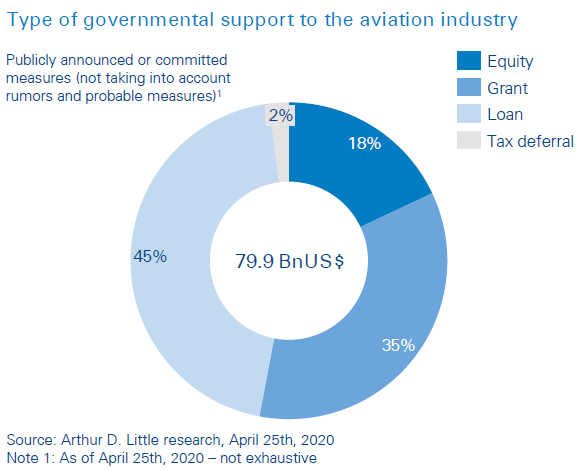

Looking at the type of support governments have used to relieve the aviation industry, (i) loans are the most commonly used, as they are eventually convertible. Governments are also using (ii) equity injections, (iii) grants, and (iv) payment deferrals (taxes, social security charges, etc.).

- Loans are hardly repaid if their maturity is short (e.g., four or five years): in the short-term, the post-COVID aviation industry will be more competitive than ever, and the already “weak” airlines’ economics may not have improved enough to generate the necessary cashflow to pay back the loans; the massive loans may even create financial burdens that could hamper the recovery of airlines. Ultimately, loans will have to be converted to equity, with the associated pitfall of such a scheme (see below).

- Equity injections put governments in an unsuitable role unless they condition this support to strict managerial and strategic collaterals.

- Grants have the major drawback of being mere subsidies, and government funds will never be recovered.

- Payment deferrals usually have limited effects on the industry because the related amount is small compared to the depth of the crisis for the industry.

The mix between those options varies across geographies; the US is the only country that went for massive grants.

Governments should opt for long-term loans or rapid return to private shareholding structures

Some countries consider the ability to control their air connectivity critical to ensuring their legal and business sovereignty, as well as feeding their people and economies (sometimes literally). Some other countries see airline ownership as a legacy from the past.

However, government ownership of airlines has, in most historical and recent cases, been a failure from both strategic and economic perspectives: substantial amounts of government money, as well as businesses’ and citizens’ connectivity, have been lost. Few exceptions have proved to be successful (direct or indirect) for publicly owned airlines – for example, Singapore Airlines and the turnaround of Japan Airlines between 2010 and 2012.

Public support cannot reinforce the previously inefficient and unsustainable business models of the airline industry. Ultimately, in most cases, governments should encourage their “flag carriers” to be part of multinational airline groups, which are “government agnostic” by nature.

Why so? In our view, governments cannot help airlines face business challenges, for reasons explained below.

Airlines must be agile, with few constraints other than for safety, security and corporate social responsibility

The aviation industry is hyper-competitive: airlines are multiniche businesses; most routes are “dog fights” operated by two, three, or even more players; and the market is congested. To survive and eventually thrive in such an environment, airlines must be hyper-agile and able to quickly make tough choices so they can adjust their networks and organizations to remain profitable.

In addition, governments sometimes consider airlines “flagships”, and ask them to keep operating some routes (or frequencies) to sustain the “prestige” or “image” of the country, even if this deteriorates their businesses. Governments may also – for good reasons – impose specific pricing that may serve the consumer well but prevent the airline from fully benefiting from the profit pool it may tap into. For example, governments may require airlines to charge low fares for certain routes, such as those to remote destinations, to stop airlines from making excess profits on these routes.

Governments should have high expectations of airlines in terms of safe and secure travel and CSR, but they should lower any other business constraints.

An airline’s profitability is driven by the productivity of its (i) aircraft, (ii) crews, and (iii) customer base

- Aircraft: If the government owns the airline, there tends to be stronger political influence in building up the fleet, which outweighs “technical and business considerations” that should prevail when acquiring ad hoc aircraft. Improper aircraft types could lead to revenue loss (non-optimized cabin size and density, insufficient cargo-load capacity, etc.) or higher costs (maintenance, repair and operations serve as a classic example, as well as leasing cost if their residual value is lower).

- Crews (cockpit and cabin): The annual productivity (flight hours versus wages) of their crews is a critical profit driver for airlines. State-owned airlines are typically less productive than private airlines: their crews’ annual flying hours are 10–20 percent below those of their private counterparts, they usually have more perks (although their salaries are not necessarily higher), and staff bargaining power is usually stronger – which is classically demonstrated during strikes.

- Customer base and frequent-flyer program: Customer ownership and data are increasingly valuable for any business in today’s digital age. Airlines enjoy the advantage of owning this valuable asset. Firstly, their direct distribution channels usually attract many visitors: Approximately 50 percent of air tickets worldwide are now sold directly by airlines; the billions of annual transactions generate as many more site visits and enquiries. Secondly, air travel passengers are “valuable” customers because they are typically more affluent and have some discretionary purchasing power. The downside to government ownership is a conflict of interest: they are able to foster “sweating” of customer data, when they are typically keen on regulating and protecting those customers from such data monetization. How can governments find a “sweet spot” in this dimension?

Transformations due to the wide government support must serve both citizens and the planet

Citizens worldwide are becoming de facto the next key shareholders of the airline industry, and possibly the rest of the aviation industry. Their investment must then help the industry face not only its short-term liquidity problem, but also the greatest challenges that already exist, as well as those that will remain after COVID-19. These challenges are:

- Transforming the airline industry into a fully commercial business: This will enable it to cope with its intrinsic nature and get rid of the stratification of rigid internal rules and external regulation without undermining the strictest imperative of safety and security.

- Achieving the long-promoted vision for a green aviation industry in the air and on the ground: This will facilitate sustainable growth in the industry, whose fundamentals (globalization of exchanges and travels) are currently being challenged because of environmental concerns

For the aviation industry, succeeding in those two dimensions will serve citizens and the planet. This is what government support of aviation should aim for – no more and no less.

Government support should require restructuring for competitiveness and “green” aviation models

Governments will provide the aviation industry with unprecedented grants or equity imminently. (Ultimately, loans will be converted – unless they have long maturity or competition in the aviation industry ceases and triggers higher profit, which is unlikely). Airlines must enhance their competitiveness by restructuring if they have not already done so. In exchange for loans, governments must request specific plans, and only support those that are credible.

- If private shareholders are not incentivized to implement these plans (for example, government becomes the controlling shareholder of the business), governments must ensure successful transformation of aviation into a commercial business by providing it with the right agility and capabilities to leverage its strategic assets.

- Governments must avoid replicating the past mistakes outlined earlier. They should be strict with (i) applying adequate decision-making processes and rationale, (ii) supporting adoption of business and commercial culture, and (iii) managing the potential conflicts of interest that (will) exist between their roles as regulators (for safety, security or economics) and shareholders. These commitments should be clearly announced early in the process of supporting any player.

To ensure a sustainable future for aviation by reducing its emissions, four main measures should be activated as (preferably binding) collateral to government support:

- Rejuvenating the fleet of airlines may enable significant environmental (and economic!) gains, with the most recent aircraft burning 10–15 percent less fuel per available seat kilometer.

- Incentivizing (if not enforcing) the use of sustainable aviation fuel (or financing the emergence of the associated value chain) may increase the fuel bill in the short term but would significantly contribute to lowering emissions.

- Implementing environmentally friendly approaches and optimal in-flight trajectories by mobilizing state-controlled air navigation service providers will adapt their processes and reorganize the air space to reduce fuel consumption by a further 5–10 percent.

- Fostering “green” CAPEX more than capacity CAPEX at airports: Specifically through new economic regulation or concession contracts to (i) enforce emission neutrality of airports (e.g., auxiliary power unit-off policies, energy-neutral buildings, emission-free fleet vehicles) and (ii) smart use of existing capacity through process automation and digitally enabled resource management.

“Aviation year zero” is 2020 . The future is reinvention – for both aviation and the role of governments investing in the industry.