The US recreational boating market faces a variety of challenges today, including flattening growth with a deceleration of new boaters following the flooding of the market during the pandemic and a trending decrease in boat ownership. While increasing vertical integration led by the market leaders has provided benefits to customers, it has also challenged the position of boatbuilders, component providers, and engine manufacturers across the value chain. These players will need to refocus their investments and develop partnerships and new revenue sources to maintain competitiveness.

STORMY WATERS IN US BOATING MARKET

The future of recreational boating in the US is unsettled. Despite the boom over the last 10 years, particularly during the pandemic, the industry faces many and increasingly significant challenges that are making it harder for marine players to navigate the market. New boaters are no longer flocking to buy boats due to rising prices; average consumers no longer have the time they had during the pandemic to understand boating’s complexity, discouraging first-time buyers; and high interest rates are making financing ever more burdensome. On top of this, market players now face the added difficulty of dealing with an increasingly dominant market leader position that is taking hold across the value chain, affecting not only engine manufacturers but also boat OEMs, component suppliers, and even boat renters. Thus, the prevailing winds are creating a choppy marketplace. However, opportunities to innovate, partner, and grow lie across the horizon to combat today’s stormy market conditions.

The tide is turning

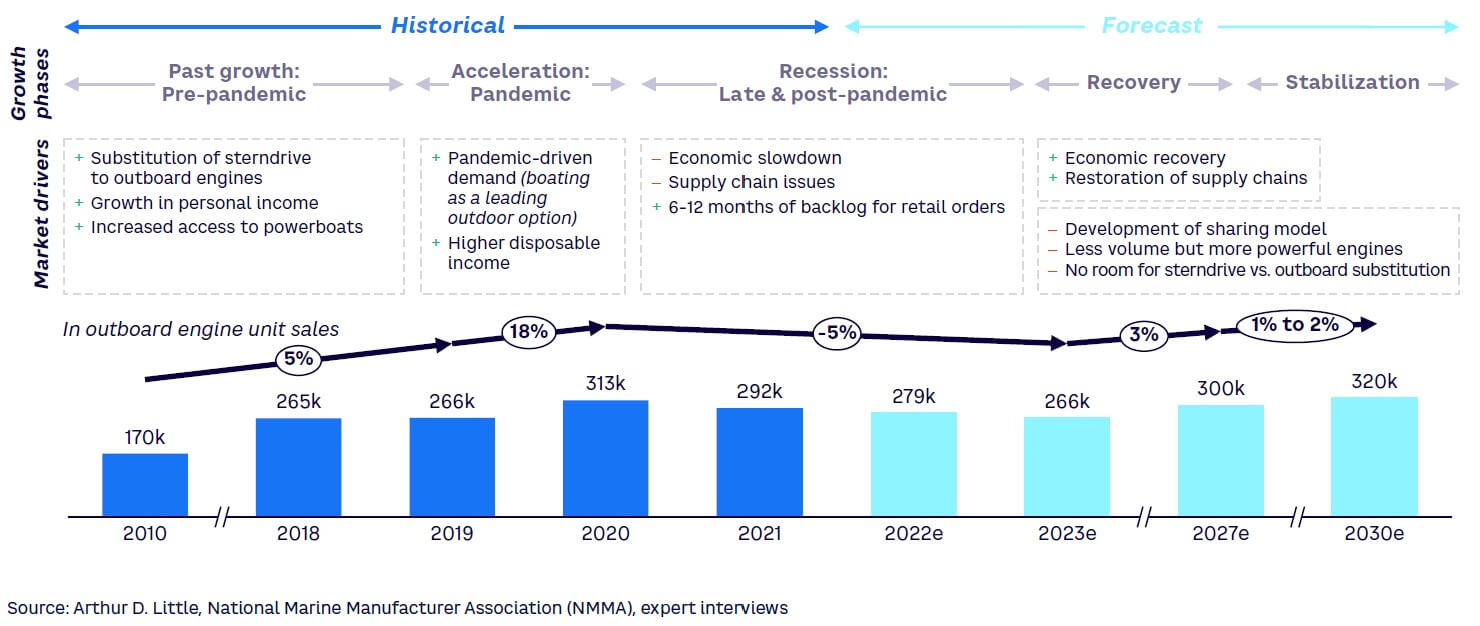

Since the Great Recession, the US recreational boating market has experienced consistent growth. Outboard engines essentially replaced sterndrives, propelling this category to a 5% CAGR, which now represents 90% of all boat sales by volume, according to the National Marine Manufacturer Association (NMMA). Then the world shut down. During a time when stay-at-home orders and a fear of COVID-19 fueled the “Zoom Revolution,” families were searching for more ways to get out of the house safely. This drove a boom in the boating market, which experienced an astounding 18% growth during 2020, pushing demand far beyond the supply chain’s limit. As the world began to reopen in 2021, the pandemic driver subsided and the boating market started to decline. Looking out at the horizon shown in Figure 1, after a few years of managing COVID backlogs, the outboard boat market is expected to stabilize at a low and slow 1%-2% growth, with high-power engines taking increasing shares.

Fishing for first-time buyers

One considerably positive impact of the pandemic was the influx of first-time boat buyers to the market, representing 31% of all buyers in 2021, according to NMMA, as well as a shift toward younger buyers. During the pandemic, the number of new boat buyers under the age of 50 surpassed buyers over 55, and despite the benefits this has provided to the industry, it now presents a range of new challenges, including:

- Keeping these new young boaters, who have primarily purchased cruisers, pontoons, personal watercraft, runabouts, and towboats, in the market.

- Encouraging these new boaters to transition to larger boats in the long term.

- Maintaining a new influx of young boaters post pandemic.

Untying the ropes holding back buyers

Unfortunately, in today’s turbulent economic conditions, consumers face a range of financial pushbacks that makes it difficult to make the leap toward ownership. Over the last year specifically, higher interest rates not seen since the early 1990s have impacted the affordability of financing large purchases such as boats. In addition, the true costs of boat ownership have increased in all areas, including fixed (e.g., engine and hull) and operational (e.g., fuel) costs. Plus, the market now faces a much smaller influx of new boaters.

Fortunately, innovative market players have found a new avenue to attract the everyday consumer to the market through boat clubs, such as Freedom Boat Club, which offers thousands of members the chance to rent all kinds of boats without any of the up-front costs of ownership. Clubs offer a variety of plans, along with boat training, maintenance, storage, and insurance, making membership an easy choice for many first-time boaters.

At the same time, boating has been made simpler, safer, and more relaxing with the development of technologies such as joystick maneuvering and remote monitoring, complemented by technology such as Stereo Vision and LiDAR (light detection and ranging) obstacle detection and docking assistance. Despite these technological improvements, however, safe boating remains complex for the average person. Such a large range of instrumentation and navigation equipment to learn creates a big hurdle for new boaters, hampering the industry’s ability to attract new customers. Nonetheless, these barriers provide opportunities for the boating industry to look at new revenue sources to grow resilient profit streams through innovative technology and boat clubs that further facilitate boating’s accessibility.

MOVING TOWARD GREATER VERTICAL INTEGRATION

Historically, the boating industry has been very fragmented, with all players along the supply chain participating individually and with their own respective consumers. However, in recent years market leader Brunswick has begun to uproot this landscape with a bold, vertically integrated approach in which the company has acquired boat OEMs, component manufacturers, boat clubs, and more, to create a seamlessly integrated portfolio. This has offered significant benefits to the customer, enabling a better value proposition with greater transparency and superior tailoring, although it does pose challenges for others in the value chain.

The benefits & challenges of a closed, integrated system

Brunswick’s vertical integration plan for the boating industry is very much the approach the commercial vehicles (CV) industry took two decades ago. Pre-2000, the CV industry comprised many specialized suppliers, which led overall to lower vehicle fuel economy as well as other problems associated with vehicle maintenance and repair. These issues arose primarily from individual suppliers that optimized the manufacturing of their individual powertrain subparts rather than codeveloping to make a complete, optimized powertrain.

In the early 2000s, the large OEMs (Daimler, Volvo, Paccar) took charge and began to take a vertically integrated approach. Daimler pursued an inorganic approach when it bought Detroit engines and transmissions, whereas Volvo pursued an organic approach by initially using its own engines in its fleets and then later developing and manufacturing transmissions. Importantly, both approaches required large amounts of capital, highlighted by Navistar nearly going bankrupt when it attempted to introduce its own engine line. Nonetheless, the likes of Daimler and Volvo have reaped great success from their early strategic investments.

As a result of these strategies, there was a significant reduction in the number of players in the CV market. Fortunately for the consumer, it led to more efficient CVs with better fuel economy, smoother driving, and more reliable engines. The key market players now run a more profitable business through the standardization of their offerings, leading to larger economies of scale and less lag time in procurement and manufacturing. In addition, the increased control on manufacturing across the value chain now allows for quicker integration of customer feedback into product development.

Returning to the boating industry, the vertical integration strategy has resulted in many such benefits, both for consumers and operations. Similar to the OEMs in the CV industry, such a strategy makes the product development process easier, as the integration of boat systems can be tested in depth and in coordination with different business units. It can also enhance the ability to understand the market and the needs of end customers, due to a greater number of consumer touchpoints, allowing for future proofing of sales as consumer demands shift. Financially, this approach brings about lower costs, as parts and equipment can be internally sourced, creating the additional ability to outprice other competitors. Such an approach is not a minor feat and requires extraordinary amounts of capital, which is especially hard in today’s economy.

Brunswick has made a concerted effort to utilize all its resources (e.g., MerCruiser, Outboard, and Racing Teams) to improve its reputation regarding reliability, elevate the boating experience, and appeal to an expanded customer base and new demographics. As part of its mission, Brunswick has invested more in R&D than its competitors in the past five years. The company has also made a time investment in its customers, involving them and integrating their feedback throughout the product development process. This feedback improves the end product while instilling a sense of confidence in the company’s ability to lead in the future. The result is product development execution on a shorter timescale and with higher performance — specifically in regard to key specs (e.g., engine fuel efficiency, power-to-weight ratio, noise level, and visual appeal).

However, vertical integration does pose challenges for others in the boating value chain. For example, other boatbuilders now face direct competition from brands owned by Brunswick, such as Sea Ray, Boston Whaler, Bayliner, Crestliner, Cypress Cay, and many others, encompassing a wide variety of boat types. With an engine being a significant portion of a boat’s cost, increased prices mean boatbuilders that depend on Mercury engines must raise prices or significantly decrease their margins. Boatbuilders are making strategic trade-off decisions between enjoying the benefits of putting Brunswick’s recently launched high-performing engines on their boats versus the risk of losing market share if they don’t.

Similar challenges are faced by component suppliers. One of the effects of vertical integration is that Brunswick is now developing power systems, digital systems, fishing systems, and performance components to create a seamless boating experience. As an example, Mastervolt, acquired by Brunswick in 2018, developed the Fathom e-power system to replace traditional generator systems. Fathom uses an intelligent platform to efficiently charge starter and storage batteries separately when docked and connects the engine’s alternator to charge when away from the dock. The system connects to other electrical components as well, ensuring a seamless connection between components. Through ownership of the Freedom Boat Club, which holds around two-thirds of the boat club market share in the US, Brunswick has captured key sales and testing channels. The company also controls the club’s representation of boats — hull, engine, components, and everything in between. Boat clubs provide a good network for fostering adoption of electric engines, and act as a test bed for new connected, automated, shared, and electric offerings.

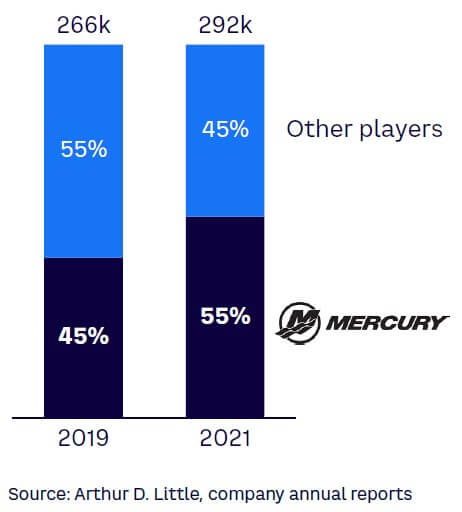

Moving to engines, the market leader among engine manufacturers has changed over time. Led by Evinrude and Mercury during much of the 20th century, it splintered into several major players, only to be captured by Yamaha, thanks to their product reliability and durability in the early 2000s. Brunswick is also now leading in market share, helped by an R&D push to develop new engines over a wide range of horsepower (hp), while at the same time expanding the commercial range with its introduction of the Mercury Verado V12 600 — the most powerful mass-produced engine on the market (see Figure 2).

Maintaining competition in the boating market

Today’s current connected component offerings from providers such as Raymarine, Garmin, and others have focused on limiting integration capabilities with their competitors. Due to branded implementations of marine communication standard NMEA 2000 and ethernet solutions (boat component networks), customers are often unable to mix offerings unless the component supplier has coordinated the development of the product with the core player. The current situation tends to force customers to rely on a specific component provider.

To remain competitive in the more vertically integrated landscape, suppliers must continue investing in their technology while leveraging key partnerships to extend the value of their products. They need to organize around a common platform to enable seamless integration across all boat systems rather than following a capital-intensive, full-service provider strategy.

Additionally, customers demand high levels of performance across all functions of their boats, from consistent steering and handling to real-time displays and easy-to-use interfaces, especially in the age of digital controls. Communications among systems must be as quick and accurate as possible. Through coordination with their suppliers, boatbuilders can create a seamless integration of all boat components and provide the customer a top-tier performance package. This can be integrated with OEM specialization to develop boats that are better equipped for a particular niche rather than a one-boat-fits-all model, and provide the ultimate boating experience directly tailored to customer wants and needs.

Conclusion

RIGHTING THE SHIP

The consolidation of market players and increased barriers to entry for competitors have changed the recreational boating market. While this has delivered a range of customer benefits up to now, to maintain healthy competition across the market going forward, boatbuilders, component suppliers, and engine manufacturers, once focused on their individual places within the value chain, need to embrace greater collaboration to develop boats and services that offer better and more seamless solutions to customers.

Players that continue to operate in their legacy position face risk from the evolving vertically integrated business model. Only a proactive reorientation of business models, partnerships, and investment strategies will protect companies from the overarching transition to an integrated marketplace. Time is of the essence, as the deep pockets of market leaders allow them to rapidly invest in product R&D and market consolidation across the value chain. To prepare for the competition, businesses must quickly realign R&D strategies to ensure high performance of core technology, develop partnerships to extend products’ value, and engage with customers.

As a whole, the market would benefit from a common boat ecosystem that players can plug into. Such a centralized ecosystem would allow for greater cohesion between key boating components and would avert consumers from depending on a specific technology. It would facilitate a seamless package while providing customers with greater vendor flexibility, customization, and ease of use. Such an ecosystem can also accelerate the pace of integration of innovative technologies as it is not dependent only on in-house development but the synthesis of software and hardware technology throughout the market, delivering on the needs and concerns of the customer while maintaining innovation-fueled competition within the marketplace.